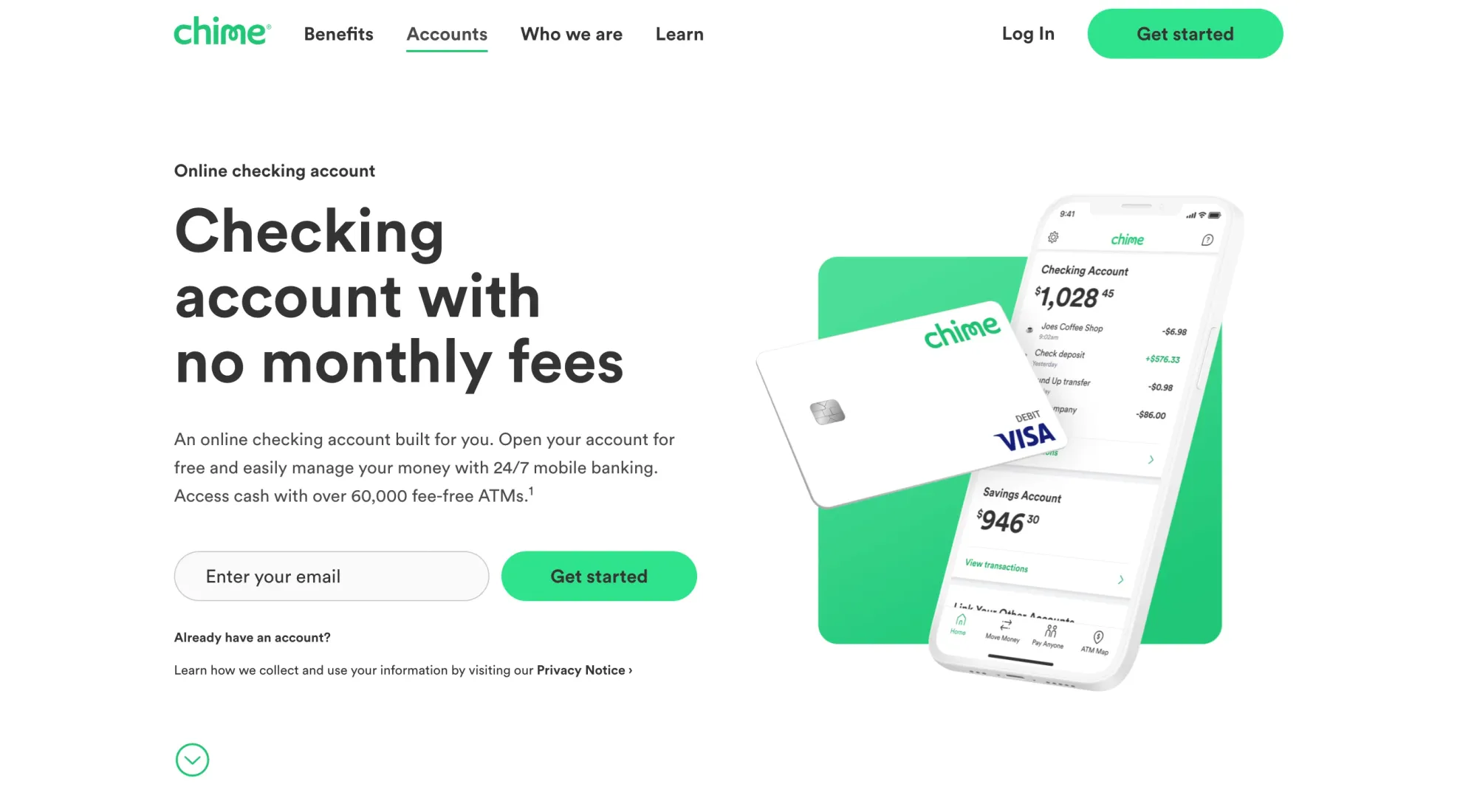

Chime: The Modern Way to Manage Your Money In today’s fast-paced digital world, banking has evolved beyond traditional branches and paperwork. Chime has emerged as one of the leading financial technology platforms, reshaping how people handle money. Known for its simplicity, transparency, and customer-friendly features, Chime is not just another online bank—it’s a smarter way to manage finances. What is Chime? Chime is a financial technology company that partners with FDIC-insured banks to deliver modern banking services without the headaches of traditional banking. Unlike old-school banks that charge hidden fees and require minimum balances, Chime offers a streamlined mobile-first experience. Its focus is on giving users control, flexibility, and financial peace of mind. Key Features of Chime No Hidden Fees Chime eliminates common banking charges like overdraft fees, maintenance fees, and minimum balance requirements. This makes it appealing for anyone tired of losing money to surprise deductions. Get Paid Early With Chime’s direct deposit feature, users can receive their paycheck up to two days earlier than with traditional banks. This is a game-changer for individuals who need quicker access to their money. Automatic Savings Chime helps customers save effortlessly. Whenever you use your Chime debit card, transactions can be rounded up to the nearest dollar, with the extra change automatically added to savings. This “set it and forget it” method makes saving money simple. SpotMe® Overdraft Protection Unlike banks that charge hefty overdraft fees, Chime offers SpotMe®—a feature that lets eligible members overdraft up to a certain limit with no fees. Instead of penalties, Chime offers flexibility and trust. User-Friendly Mobile App The Chime app provides real-time transaction alerts, instant transfers, and easy budgeting tools. It’s designed for users who want to track spending and manage accounts on the go. Why Choose Chime? Chime’s appeal lies in its commitment to customer empowerment. Traditional banks often profit from fees and complex systems, but Chime takes a different approach by focusing on accessibility and transparency. Whether you’re a student, freelancer, or professional, Chime makes it easier to stay on top of your finances without stress. Safety and Security Security is a top priority with Chime. Accounts are FDIC-insured up to $250,000, and the app comes with features like real-time alerts, card blocking, and two-factor authentication. This ensures users can bank with confidence, knowing their money is safe. The Future of Banking with Chime As more people embrace digital solutions, platforms like Chime are setting the standard for the future of banking. With features designed to simplify saving, spending, and managing money, Chime continues to attract millions of users who prefer a modern, fee-free alternative. Final Thoughts Chime is more than just an online banking option—it’s a financial tool built for today’s lifestyle. From early paycheck access to automated savings and zero hidden fees, it empowers users to take control of their money. If you’re looking for a simple, secure, and customer-focused way to bank, Chime might be the perfect fit for you.